standard depreciation rate malaysia

Given the reassessment of the useful life and residual value the depreciable amount at the end of 20X6 is 168000 180000 - 12000 which must be depreciated over the next three years. Depreciation is what happens when a business asset loses value over time.

Calculation of the first annuity.

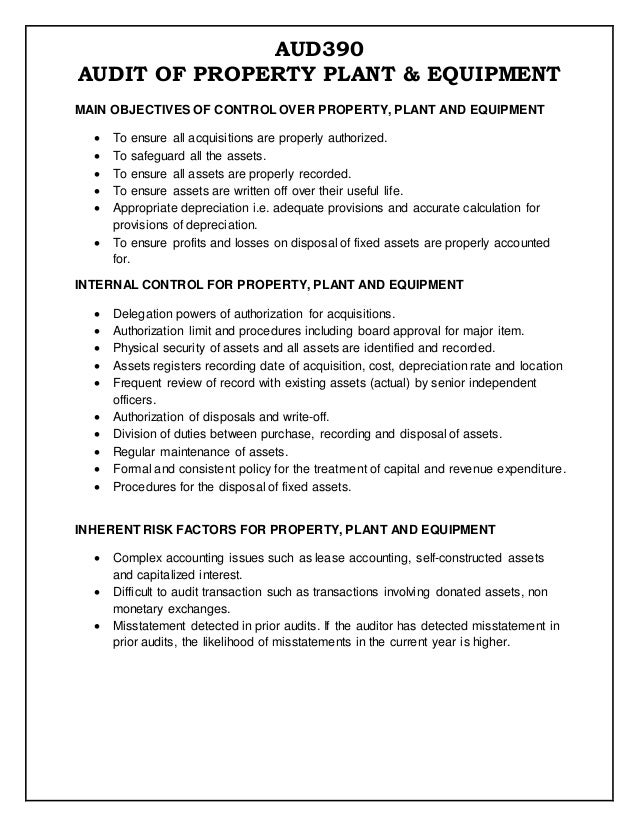

. Depreciation period Double Decline Method. This Standard supersedes MASB Approved Accounting Standard IAS 16 Property Plant and Equipment. This Standard should be applied in accounting for depreciation.

Depreciation Method is SLM. Annual Depreciation for 2010 would be. The objective of this Standard is to ensure uniformity of treatment and reporting of pre-cropping costs in Malaysian plantation operations.

Since 29 September however the currency has appreciated 62 on the back government-led intervention in the stock market and a temporary rally in oil prices. Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or profession provided certain conditions are met. These costs are referred to as pre-cropping costs in this Standard.

020 x 210360 x 12000 1400. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam electric NHRS Waste heat recovery Boilersplants784 iii Diesel electric and Gas plant824 b Cooling towers and circulating water systems784 c Hydraulic works forming part of Hydro-electric system. 21500 0 20 years 1075 annual depreciation.

While annual allowance is a flat rate given every year based on the original cost of the asset. The MPERS is a new financial reporting framework for private entities in Malaysia. MASB - Malaysian Accounting Standards Board.

Conclusion Office equipment includes assets that companies acquire for office use. Again depreciation 10 per annum will be calculated on the acquisition value for the entire useful life of the asset from the date of acquisition. Depreciation rate x number of days used360 x Depreciable basis Example The car is put into service on the 0106N.

- Initial allowance IA. 10 on 10000 1000 and this will be same for next 8 years. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

There are techniques for measuring the declining value of those assets and showing it in your businesss books. B forests and similar regenerative natural resources. This Standard does not apply to.

Renovation depreciation rate in malaysia 2020. C expenditures on the exploration for and extraction of minerals. Depreciation should be charged to profit or loss unless it is included in the carrying amount of another asset IAS 1648.

The deduction is limited to 10 of the aggregate income of that company for a year of assessment. The company can use the following journal entries for the office equipment depreciation. Can charge this amount in the accounts each year.

This Standard applies to all depreciable assets except. The ringgit has decline 275 against the USD since the start of the year. Rate as per straight-line method 2 10 2 20.

This Standard should be applied in accounting for all pre-cropping costs incurred as part of plantation operations. General rates of allowance for Industrial building whether constructed or purchased. These may consist of various items as listed above.

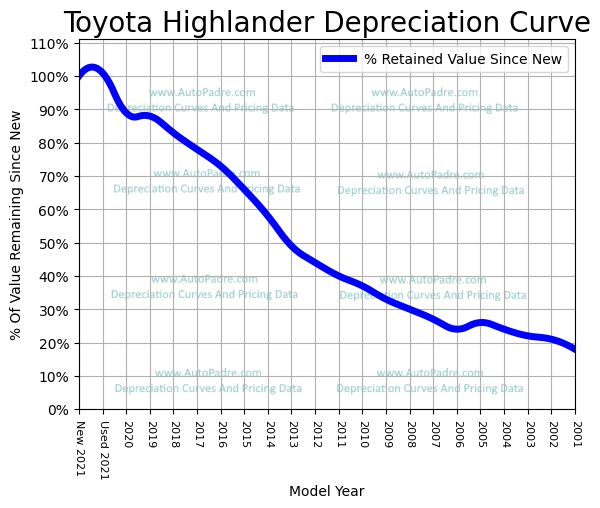

Theres no formula to calculate car depreciation it depends heavily on brand and model. IAS 1655 Recoverability of the carrying amount. In this article we give an overview of the MPERS highlight some key differences with the Malaysian.

Taxes Taxes on income are generally not deductible whereas indirect taxes are. The result would look something like this. Depreciation begins when the asset is available for use and continues until the asset is derecognised even if it is idle.

Depreciation expense for the Year 2028 is kept at 2422 to maintain the salvage value at the end of 10 Years. My guess is RM70k. Depreciation for subsequent years considering storage tanks are bought at the start of FY19 is as follows.

It will therefore only be used for 210 days out of 360 in year N and for 150 days in year N5. Depreciation 10000 0 5 years Depreciation 2000 Blue Co. A work computer for example gradually depreciates from its original purchase price down to 0 as it moves through its productive life.

Fines and penalties Fines and penalties are generally not deductible. 20 on 10000 2000. The Malaysian Accounting Standards Board launched the Malaysian Private Entities Reporting Standards MPERS on 27 October 2015.

Therefore the depreciation expense in 20X7 20X8 and 20X9 will be 56000 168000 3 years per year unless there are future changes in estimates. A property plant and equipment see MASB 15 Property Plant and Equipment. Since theres no 2 years old Inspira on the road we could only guess.

First Initial Depreciation would be. This Standard should be applied in accounting for property plant and equipment except when another MASB Standard requires or permits a different accounting treatment. 10 - Annual allowance AA.

Of course there are many software programs out there that will not only help you track your organizations assets but will also calculate depreciation and produce reports for you. The ringgit has been attacked on.

Fixed Asset Depreciation Rate In Malaysia 2017 Lincolnctzx

Sustainability Free Full Text Challenges Of Electric Vehicles And Their Prospects In Malaysia A Comprehensive Review Html

Pdf The Impact Of Foreign Workers On Labour Productivity In Malaysian Manufacturing Sector

Topic 11 Notes And Question On Ppe

Toyota Highlander Depreciation Rate Curve

Estimates Of Trade Balance Equation Download Table

Despite Pressures The Indian Rupee S Remarkable Resilience The Hindu

Here S Why Iphone 13 And Iphone 13 Pro Prices Are Still So High Bgr

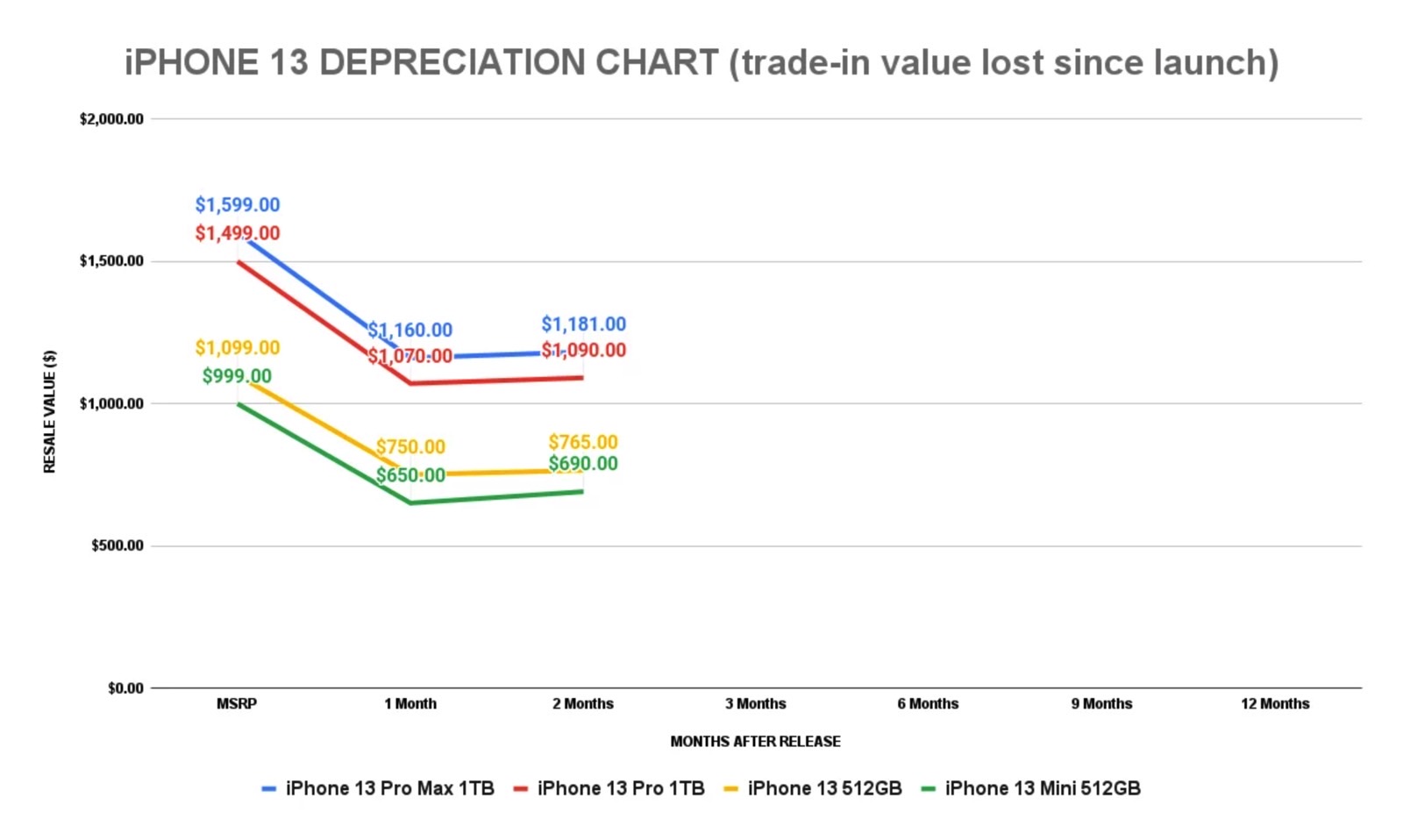

Risks Free Full Text Creative Accounting Determinants And Financial Reporting Quality Systematic Literature Review Html

Brief Summary Of Ias 16 Property Plant Equipment

Betterment In Motor Insurance Explained The Star

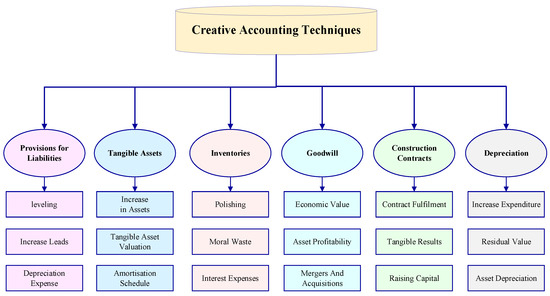

Has The Advent Of Green Office Buildings Influenced The Rental Depreciation Of Conventional Office Buildings A Case Study In The Kuala Lumpur Golden Triangle Springerlink

Depreciation Schedule Template For Straight Line And Declining Balance

Mfrs 116 Property Mfrs 116 Property Plant And Equipment Mfrs 116 Are Tangible Asset That Are Held For Use In The Production Or Supply Of Goods Course Hero

Department Of Statistics Malaysia Official Portal

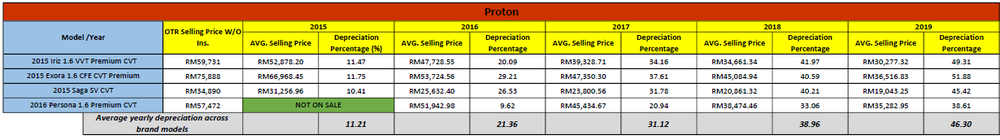

The Projected Resale Value Of The Proton X50 In The Next Five Years Insights Carlist My

No comments for "standard depreciation rate malaysia"

Post a Comment